Just in time for holiday shopping:

Get free cash when you shop online with eBates.

Get $10 to start you off!

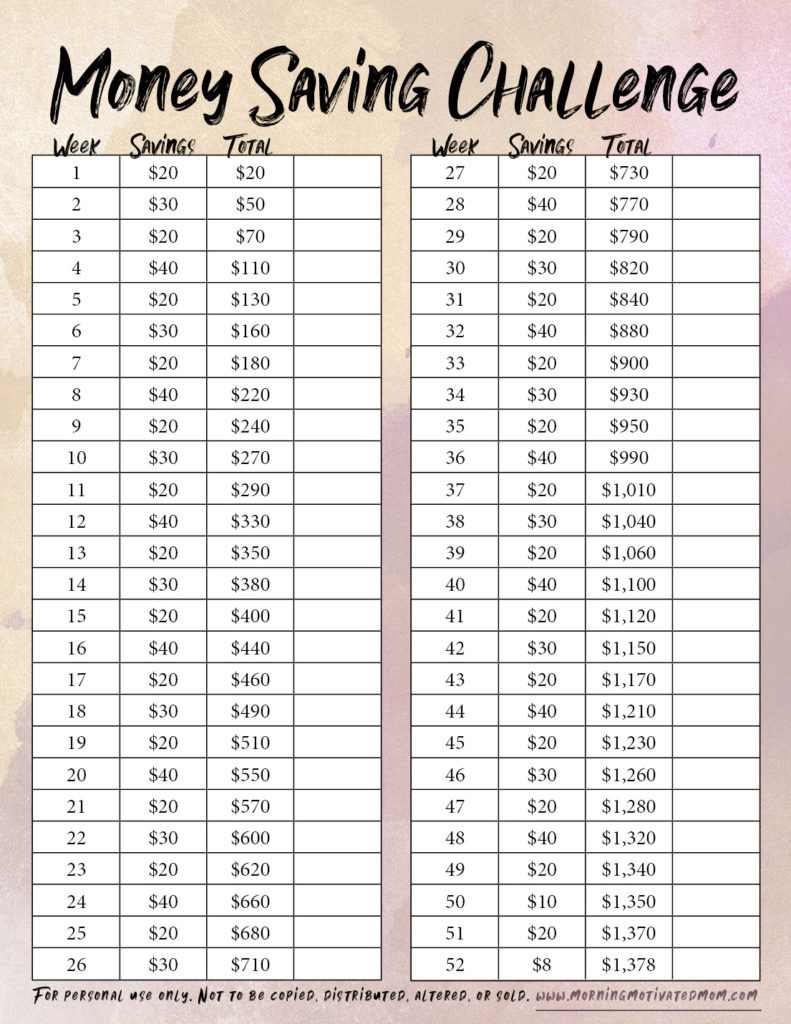

I like the idea of the 52 Week Money Challenge that is often shared online, but I’m not 100% on board. The plan has you saving $1 the first week, $2 the second week, $3 the third week…until you save $52 the last week of the year. It’s a simplistic way to save an additional $1,378 in one year, but I do see how this can be a struggle when December rolls around.

The first 4 weeks of the year, you save $10. This is an average of $2.50 per week.

The last 4 weeks of the year, you save $202. This is an average of $50.50 per week. In December.

Saving $2.50 per week is probably easy for most, but $50.50 per week can be much harder! Especially during the holidays.

The 52 Week Money Saving Challenge Printable I created for you fluctuates somewhat, but you will be able to breathe easy towards the end of the year. In fact, the month that asks you to save the least amount is December!

FREE Printable:

52 Week Money Saving Challenge PDF

You will save $110 each 4 week cycle, which an exception of the last 4 weeks of the year. If cash is tighter for you in December, you will feel relief. This plan asks you to save only $58 for the last 4 week cycle. You will only have to find $8 in your budget to save the last week of the year, much easier than $52!

It’s easier to stay focused on saving when you remember what your goals are. Writing it down can also make you feel more accountable to it.

Vacation? Home updates? Kiddo’s college fund? Credit card debt?

What are you saving for?

Print out the schedule and start saving in 2015!

Printable: 52 Week Money Saving Challenge PDF

Find more 52 Week Money Saving Challenge printables in this post!

You will receive free updates, morning motivation, printables, blog post highlights, and occasional deals sent your way. Frequency?? Just a few times per month.

Sarah Jane says

Thanks for this. I agree with you re. the plan to save money and increase it by $1 every week. With the Holidays in December, that’s the time of year that we spend the most money.