Shopping online? Get cash back + a $40 bonus. It takes seconds and the cash back adds up!

I’ve earned over $1,000 in cash back just for shopping online. Grab a $30 bonus just for shopping online. All you have to do is click through Rakuten (it takes seconds!) and you’ll earn cash back. Grab your $30 bonus to start HERE.

Are you familiar with the 52 Week Money Saving Challenge? I like the idea of a savings challenge, but I am not 100% on board with how it is set up. The typical plan challenges you to save $1 the first week, $2 the second week…until you save $52 the last week of the year. It’s a simple way to save an additional $1,378 in 52 weeks, but I do see how this can be a struggle when December rolls around.

Compare what you are saving the first 4 weeks of the year to the last 4 weeks of the year.

- During the first 4 weeks, you save a total of $10. Average: $2.50 per week.

- During the last 4 weeks, you save a total of $202. Average: $50.50 per week.

Saving $2.50 per week is probably not a huge struggle. $50.50 per week may be harder to accomplish, especially considering that this takes place in December.

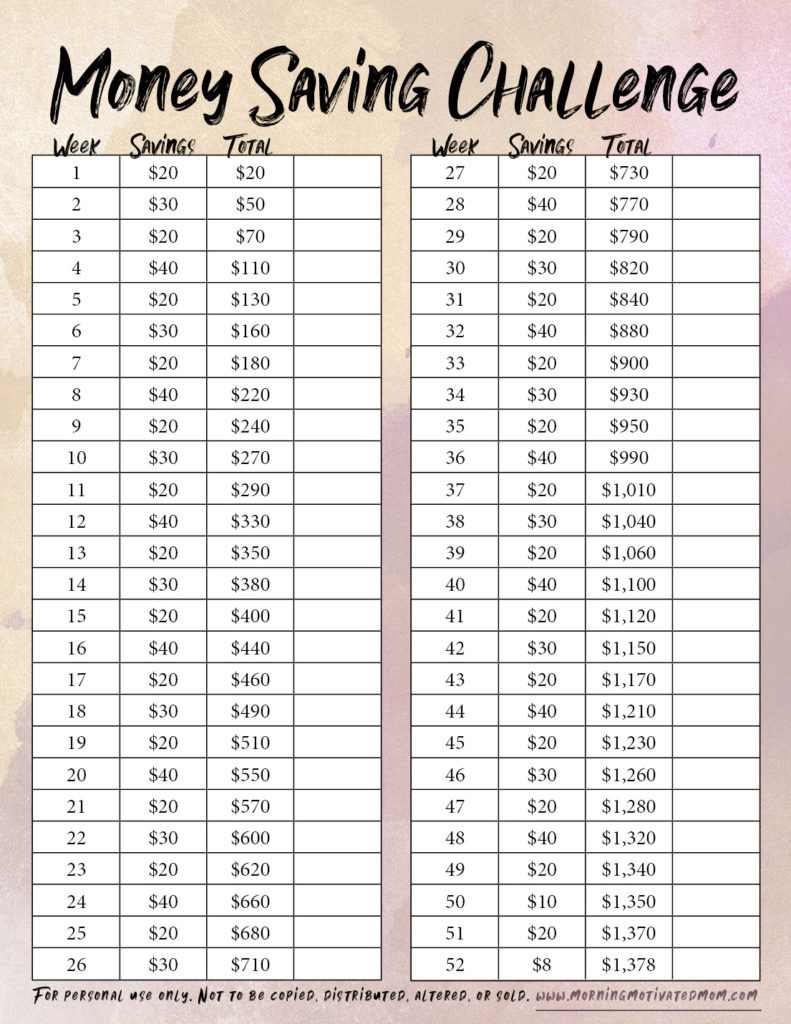

I created a 52-Week Money Saving Challenge Printable back in 2014. The original printable was for 2015, but now I have an undated version for you to use any year. You can start this challenge at any point throughout the year.

The original 52-Week Money Saving Challenge ($1 per week, $2 per week, etc.) results in a savings of $1,378 in a year. You will still end up saving $1,378 with this updated challenge, but it will be easier to save when you spread it out.

If you do decide to start this challenge in January, this schedule will be much easier as you will be set up to save the least amount in December. You will save $110 during each 4-week cycle, with an exception of the last 4 weeks of the year. If money is tight in December, you will feel relief! This schedule asks you to save only $58 during the last 4 weeks. You will only have to set aside $8 in your budget to save the last week of the year. $8 is much easier than $52!

FREE Printable: 52 Week Money Saving Challenge

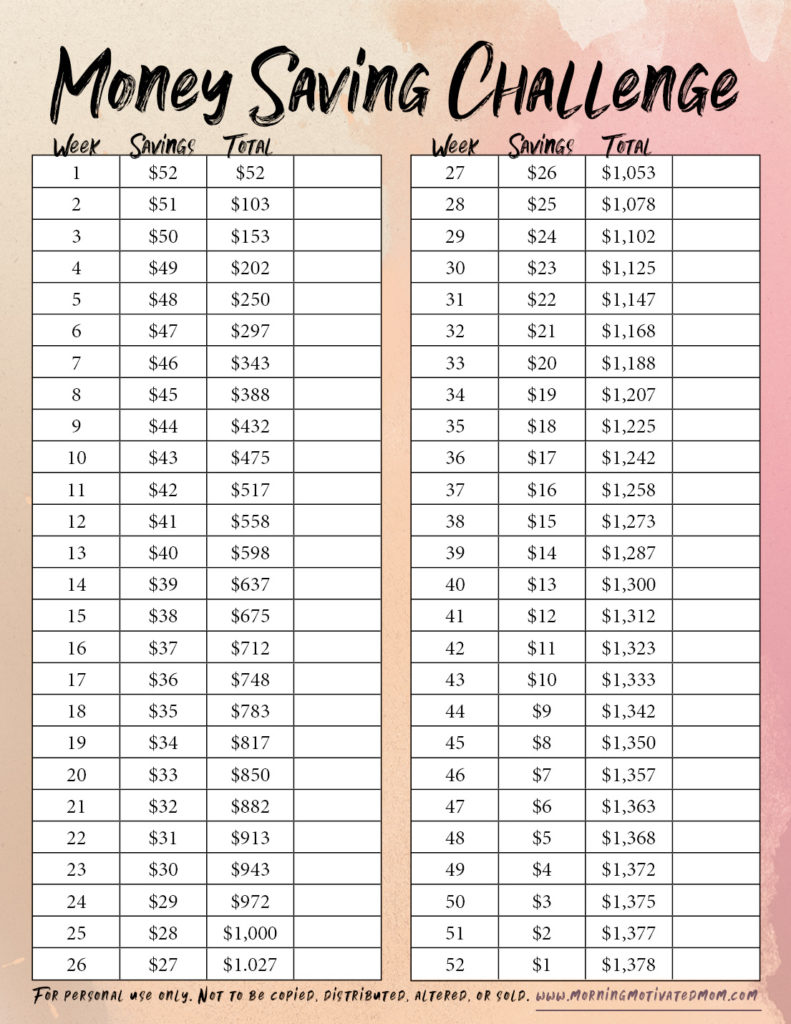

I am also including the reverse version of the original challenge. Save $52 the first week, $51 the second week…until you save $1 the last week. Pick the schedule that works best for you.

FREE Printable: 52 Week Money Saving Challenge_Reverse

It can be easier to make saving a priority when you know what your goals are. Writing down your goals can make you feel more accountable. At the bottom of the printable, there is a place to write down your savings goal.

Write down what you are saving for: Mortgage? Vacation? Home updates? College fund? Credit card debt? Feel free to share in the comments:

Why are you saving? What is your goal?

Do you want to track your habits in 2024? See below for a few resources to help you track your habits:

Monthly Habit Tracker: This post includes a free monthly habit tracker PDF.

Bundle of 20+ Habit Tracker PDFs: Because I realize not everyone tracks their habits in the same way, I just created a Habit Tracker Printable Bundle. It contains over 20 pages so you can find the tracker that works for you. Some trackers have a weekly focus and some have a monthly focus. Some include both. There is also be a habit tracker specific for tracking sleep. Work through and try more than one printable until you find the one that works best for you. Get the NEW Habit Tracker Bundle here!

Habit Tracker Spreadsheet: I am excited to share my Habit Tracker Spreadsheet with you. One of the reasons I’m so excited about the spreadsheet is that you get to see the word “Success” pop up if you complete your habit your goal number of days.

There is a column where you write in your success criteria (because not all habits will have the goal of 7 days per week). Once you input the right number of “X”s during the week, a green “Success” will magically pop up! (OK…it’s just a little formula I wrote.)

![]()

I included directions in the spreadsheet, but I would love to know if you think something is confusing.

[thrive_leads id=’11190′]

Annual Habit Tracker: Track your habits all year long with this free Annual Habit Tracker Printable. This post also includes ideas for what habits to track.

Don’t forget to PIN this post for later!

You will receive free updates, morning motivation, printables, blog post highlights, and occasional deals sent your way. Frequency?? Just a few times per month.

Sarah says

I love the changes that you made! We tried this once (using the 1, 2, 3, etc.) method but it didn’t last long. I think we may give this schedule a try!

Emily says

I hope it works better for you, Sarah!

Kelly says

I totally agree with you on how the original was set up. I really like the new updated one! Much easier to put into practice! Thanks so much for sharing!

Stasia says

Love this! We may start now! No need to wait until January!

Emily says

Let me know how it works for you, Stasia!

Lisa Morris says

Hi! Thank you for this printable! Love it. Going to do my best to get started and stay with it! Looks doable:) Visiting from Faith and Fellowship Blog Hop!

Emily says

Good luck. :)

Heather @ Simply Save says

It can be hard to save that much during the holidays, but I’ve heard of a modified challenge where you don’t go in any order, you just set aside an amount each week and mark it off the list as you go. It could be $30 one week and $2 the next week. But the total saved in the end is the same! Thanks for sharing on #SmallVictoriesSundayLinkup!

Emily says

That is a great way to do it! Thanks for sharing.

Jessica says

Great idea!! This would be great to try! Thanks for sharing!!

Kim says

Great ideas and thanks for the printable…I am very visual and need to physically check things off in order to feel they are complete. Thanks.

Emily says

I am with you! I like to check things off also. Thanks for stopping by.

Liz Jo says

Love this idea! I may have to print this out and start now even if it’s in the end of the year. We usually take out 20% of each of our paychecks, but this sounds like a great idea as well just another way to save money.

liz @ sundays with sophie

Amy says

This is wonderful! We’re going to start the 1st week of November and that way this can be our Christmas savings for next year. Have you or would you make a kid’s saving printable? Our son is starting to get an allowance and I would love for him to have a check sheet too. His allowance is going to be $10 every 2 weeks. He knows some will go to savings and other for spending but I would love for us to do this together.

Emily says

Yes, I do have a few children’s versions. They have the 2015 date on the top, but the weeks are not dated so you will still be able to use it. The 3 versions are: 1) $1 per week 2) Increasing from $1 per week to $4 per week 3) Blank – fill in the amount.

You can find them here: https://www.morningmotivatedmom.com/money-saving-challenge-kids-printable/

I hope they work for you!

Heather @GeminiRed Creations says

Your two new templates make a lot more sense to me. December is usually the toughest for people because they are shopping for gifts, heating costs go up, and any other number of things you can think of. When I originally saw the idea floating around Facebook I was thinking it probably made more sense to run from November 1st – October 31st each year so that you have your $1,378 to shop during the months of November and December (if you were using the money to save for Christmas or Hanukkah shopping. The first one of going $20 to $30 back to $20 is similar to training for a marathon – you do a short run/walk, a long walk, back down to a short walk to work your way up to 26.2 miles. And, going backwards is definitely a good idea! Thanks for sharing with #SmallVictoriesSundayLinkup

Cathy says

I love this, and I just printed it out! I am excited to get started :-) Thanks so much for sharing this on MMM! :-) See you at the next party!

Cathy

Amanda @ The Fundamental Home says

Great printables! I thought the backwards version would be better for me, but after a little more thought, I like your balanced version. It’s great that you gave options! Thanks for sharing!

Emily says

You are welcome! I hope you found them helpful. :)

Brittany says

I love this idea! I’m planning to save more in 2017. It feels amazing to have an organized system and know that you are managing your money wisely.

Emily says

That is great you are planning to save more in 2017. Good luck!

Sylvia M. says

I also have been using the original chart to save for my yearly cruise, but it does get tougher as the year goes on, especially on a fixed income. I’m going to change to one of your systems this year and I’m betting it will be a lot easier on me. Thanks for the printouts. You’re the best!

Emily says

Great to hear! I hope the printouts work well for you. A cruise is such a fun thing to save for!

Taylor B says

I love this challenge! I’m going to be doing it this year by saving the same amount each week – $26.50 to be exact. It’ll still give me the same end result but is a bit more manageable with my current income.

By the way, I mentioned your edition of the challenge in a blog post! Hopefully it will inspire others – like it did me – to start saving once they see how easy it can be :)

Emily says

That is great you are taking the steps to save!

Thanks for mentioning my challenge. I appreciate it! Enjoy your weekend. :)

Nola Franzen says

I use this type of plan every year, except I use it in the order of: week 1, week 52, week 2, week 51, etc. It means that I save about the same amount every payday and it isn’t such a challenge. And since it goes directly to my Ally account I can’t get it immediately. One of the better ideas I use.

Emily says

That is such a great way to do it! Thanks for sharing.